News

Prof. Richard Kwasi Amankwa takes office as third UMAT Vice-Chancellor

Professor Richard Kwasi Amankwa, was last Friday, sworn into office as the third Vice Chancellor of University of Mines and Technology (UMaT), Tarkwa in the Western Region (UMaT), with a pledge to improve sustainable artisanal small- scale mining and emergency response.

“UMat will not only teach, but, also practise what it taught and requested the Minister of Land and Natural Resources to provide a mineralised land for the university to start the UMaT small scale mine.”

Before his investiture the, Chairman of the Council, Dr Steve S. Yirenkyi,led the new VC to swear the oath of office and robedhim with the VC’s robe.

Prof. Amankwa , 54, who was the Dean, Faculty of Integrated Management Science (FIMS), became a full professor in 2011.

He is a distinguished, internationally acclaimed scholar, a business-oriented academic, and had provided dedicated services for Kwame Nkrumah University of Science and Technology (KNUST) and UMaT.

He said: “This venture will grow to become a model mine and a centre for training artisanal and small scale miners in the -sub region with the best practices in resource optimisation and environmental sustainability.In addition to the potential financial rewards of such a venture,we will create more revenue for industrial training for our students and create employment for our gradates.”

“We can achieve these ideals and move towards becoming a centre of excellence and hence the MIT of Africa that the Chancellor charged us to do,if only we can build appropriate partnerships.”

Prof. Amankwaa indicated that his vision was to deepen scholarship, innovation and entrepreneurship in UMaT to drive sustainable industrial development in Ghana and beyond and believed that “this will not be the VCs vision, but, our vision for the next four years, so that together we can pursue the agenda with enthusiasm.”

He said, the vision, carved out of UMaT strategic plan, would be achieved through impact-oriented teaching, research and extension services, improved infrastructure, information communication and technology, enriched governance system and leadership, intensified financial resources mobilisation and management and enhanced student experience and development.

The President, Nana Addo Dankwa Akufo-Addo, noted that UMaT had become an engine of growth and development producing industry oriented graduates in engineering.

He said research findings put Ghana, a nation endowed with rich minerals, in a strategic position as a global leader in mining, petroleum and allied industries.

He said: “UMaT would continue to build the mindset of students to be more entrepreneurial and create the environment where they would be able to practice what they learn.

This concept is aimed at equipping graduates of the University with the capacity to set up their businesses to be employers rather than employees.”

The President urged UMaT to team up with the Ministry of Lands and Natural Resources, other ministries and the Environmental Protection Agency (EPA) to develop skills and technologies to transform small scale mining in Ghana and help sanitise galamsey, which was connected to illegal and irresponsible mining.

The Chairman of UMaT Council, Dr Steve Yirenkyi, urged all stakeholders to join Prof .Amankwa to build UMAT so that, it could fulfill its mandate of training worldclass professionals in the field of mining petroleum, technology and related disciplines for the development of Ghana.

From Clement Adzei Boye, Tarkwa

News

Man sentenced to 25 years for robbery at Manso Akwasiso

A 30-year-old man has been sentenced to 25 years imprisonment with hard labour by the Bekwai Circuit Court for his role in a 2022 robbery at a mining site at Manso Akwasiso in the Ashanti South Region.

The convict, Dominic Ofori, also known as Fanta, was arrested on 16th February 2026 after years on the run. He pleaded guilty before the Bekwai Circuit Court to robbery contrary to Section 149 of the Criminal Offences Act, 1960 Act 29, and was accordingly sentenced to 25 years imprisonment with hard labour.

On March 20, 2022, the Manso Adubia District Police received intelligence that a group of armed men from Manso Abodom were planning to attack a mining site at Manso Akwasiso to rob the owner of gold concentrate. Acting on the information, police mounted a coordinated operation and laid an ambush at the site.

At about 5:30 pm the same day, four-armed men arrived at the site, fired indiscriminately, and robbed the miners of their gold concentrate. The police team on surveillance intervened, resulting in an exchange of gunfire.

Three of the suspects, Abu Abubakar, Musah Latif, and Gideon Takyi, sustained gunshot wounds and were pronounced dead on arrival at St Martins Catholic Hospital at Agroyesum. Dominic Ofori escaped at the time but was later arrested and put before the court.

The Ashanti South Regional Police Command has assured the public of its continued commitment to combating violent crimes and bringing offenders to justice.

News

Ashanti police arrest man for publishing false news on TikTok

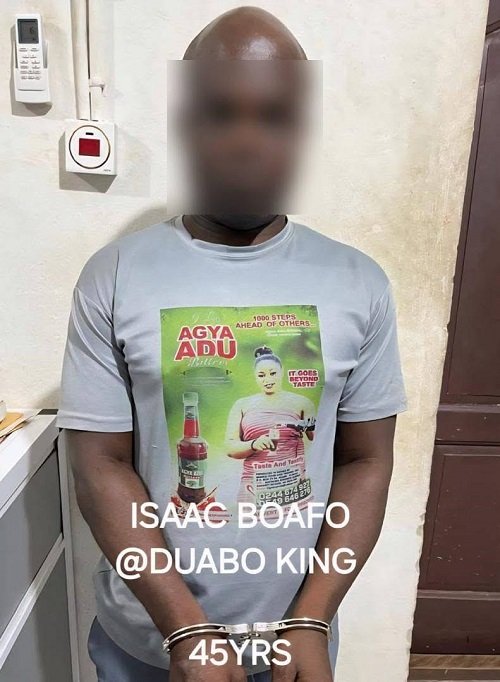

The Ashanti Regional Police Command has arrested 45-year-old Isaac Boafo, also known as “Duabo King,” for allegedly publishing false news intended to cause fear and panic.

Police said the arrest follows a viral TikTok video in which Boafo claimed that four officers at the Central Police Station in Kumasi engaged in inappropriate conduct with commercial sex workers during night patrols in Asafo.

Officers from the Police Intelligence Directorate (Ashanti Region) apprehended Boafo after receiving intelligence about the video.

During questioning, he admitted to creating the video to attract views and engagement online, and acknowledged that he could not prove the allegations.

Boafo also admitted making comments about the President of the Republic for content purposes and could not defend those statements.

He has been formally charged and is in detention as investigations continue.

The Ashanti Regional Police have warned the public against publishing or sharing false information on social media, noting that such acts can cause fear, panic, and damage reputations.

They said anyone found engaging in similar conduct will face legal action.

By: Jacob Aggrey