News

Odumase Krobo Nursing, Midwifery College initiates steps for diploma progammes

Dr Winfred Korletey Baah, the Chief Executive Officer of the Health Facilities Regulatory Agency (HeFRA), has initiated steps for the Odumase Krobo Nursing and Midwifery Training College to be accredited to start offering diploma programmes in nursing, midwifery, and public health.

Dr Baah, who is also a Consultant Physician, appealed for the fast-tracking of the accreditation process to enable it to fulfil its mandate and the mission for its establishment.

At a meeting with Dr Awoonor Williams, Technical Adviser for the Minister of Health, and the Head of the Health Training Institutions at the Ministry of Health (MoH), Dr Baah noted that most nursing and midwifery training colleges were being accredited to run degree programmes.

Dr Baah said the Odumase Krobo Nursing and Midwifery College could not continue to train and award certificates in nursing assistant (preventive) programmes only.

Established in 2015, the college has only been running a two-year health care/ nursing assistants (preventive) programme.

According to Dr Baah, the college was established to train general nurses, midwives and public health nurses.

He noted, however, that because of the delay in securing the necessary accreditation, it has been operating below its capacity and mandate, necessitating the ongoing intervention for an immediate accreditation for the commencement of diploma programmes in line with the vision that fuelled its establishment.

Dr Baah expressed optimism that with the ongoing efforts and collaboration between the MoH and HeFRA and other relevant institutions, actions and the accreditation processes would be expedited for the college to commence diploma programmes in general nursing, midwifery and public health this year.

The diploma programmes will commence this year, hopefully, given the assurances I have received from the ministry,” he said.

The college, which operated in temporary facilities for five years at Odumase, relocated to its current permanent site south of the Odumase township in 2020.

It presently boasts a population of nearly 400 students made up of first- and second-year students reading the health care/nursing assistants (preventive) programme.

—GNA

News

Man sentenced to 25 years for robbery at Manso Akwasiso

A 30-year-old man has been sentenced to 25 years imprisonment with hard labour by the Bekwai Circuit Court for his role in a 2022 robbery at a mining site at Manso Akwasiso in the Ashanti South Region.

The convict, Dominic Ofori, also known as Fanta, was arrested on 16th February 2026 after years on the run. He pleaded guilty before the Bekwai Circuit Court to robbery contrary to Section 149 of the Criminal Offences Act, 1960 Act 29, and was accordingly sentenced to 25 years imprisonment with hard labour.

On March 20, 2022, the Manso Adubia District Police received intelligence that a group of armed men from Manso Abodom were planning to attack a mining site at Manso Akwasiso to rob the owner of gold concentrate. Acting on the information, police mounted a coordinated operation and laid an ambush at the site.

At about 5:30 pm the same day, four-armed men arrived at the site, fired indiscriminately, and robbed the miners of their gold concentrate. The police team on surveillance intervened, resulting in an exchange of gunfire.

Three of the suspects, Abu Abubakar, Musah Latif, and Gideon Takyi, sustained gunshot wounds and were pronounced dead on arrival at St Martins Catholic Hospital at Agroyesum. Dominic Ofori escaped at the time but was later arrested and put before the court.

The Ashanti South Regional Police Command has assured the public of its continued commitment to combating violent crimes and bringing offenders to justice.

News

Ashanti police arrest man for publishing false news on TikTok

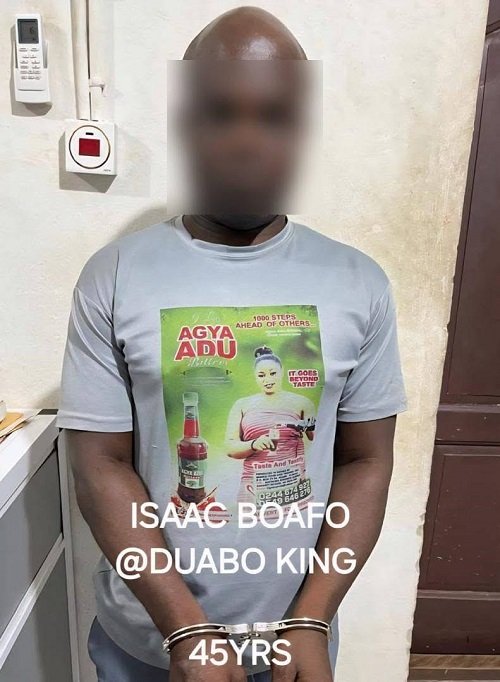

The Ashanti Regional Police Command has arrested 45-year-old Isaac Boafo, also known as “Duabo King,” for allegedly publishing false news intended to cause fear and panic.

Police said the arrest follows a viral TikTok video in which Boafo claimed that four officers at the Central Police Station in Kumasi engaged in inappropriate conduct with commercial sex workers during night patrols in Asafo.

Officers from the Police Intelligence Directorate (Ashanti Region) apprehended Boafo after receiving intelligence about the video.

During questioning, he admitted to creating the video to attract views and engagement online, and acknowledged that he could not prove the allegations.

Boafo also admitted making comments about the President of the Republic for content purposes and could not defend those statements.

He has been formally charged and is in detention as investigations continue.

The Ashanti Regional Police have warned the public against publishing or sharing false information on social media, noting that such acts can cause fear, panic, and damage reputations.

They said anyone found engaging in similar conduct will face legal action.

By: Jacob Aggrey