News

Government launches 3 new policies to speed up digital payments

The government has launched three new policy initiatives designed to deepen financial inclusion and accelerate digital payments in line with its vision of building a payment system that accelerates economic development.

The policies are National Financial Inclusion and Development Strategy, Digital FinancialServices Policy and Cash-Lite Roadmap.

Mr Ken-Ofori Atta, Minister of Finance launching the policies said “Digital payments help drive transparency, accountability, efficiency, as well as greater women’s participation in the economy. Moving away from cash helps our country advance towards achieving many of the Sustainable Development Goals.”

The National Financial Inclusion and Development Strategy, developed in collaboration with the World Bank, aims at increasing financial inclusion from currently 58 per cent to 85 per cent by 2023, helping create economic opportunities and reducing poverty.

The Digital Financial Services Policy, developed in partnership with CGAP, builds on existing technological gains to create a resilient, inclusive and innovative digital ecosystem that contributes to social development, a robust economy and a thriving private sector.

The Cash-Lite Roadmap, designed in collaboration with the United Nations-based Better Than Cash Alliance, puts forward concrete steps to build an inclusive digital payments ecosystem. This includes better access to financial services, enabling regulation and oversight, and promoting consumer protection.

According to the Finance Minister, “public and private sector actors need to work hand in hand, digitising in a responsible manner to turn these new policy initiatives into tangible benefits for all Ghanaians. These assertions are even more relevant in the era of the COVID-19 pandemic.”

In 2017, the Ghana Interbank Payment and Settlement Systems (GHIPPS) under the auspices of the Central Bank of Ghana, launched the Mobile Money Interoperability scheme to facilitate the simple and convenient movement of funds across mobile money platforms.

In November 2019, the Governor of the Bank of Ghana, Dr Ernest Addison, announced an initiative to pilot a Central Bank digital currency (CBDC) in a sandbox environment. This would foster competition, reduce the operational costs associated with cash and move the country closer to achieving its cash-lite objectives.

The Central Bank has also set up a Fintech and Innovation Office to drive the Bank’s Cash-lite, e-payments and digitisation agenda. Efforts at ensuring the development of the FinTech industry culminated in the establishment of the Ghana Chamber of Technology by industry players as its umbrella body. Among other things, the Chamber provides a forum for FinTechs and Payment Service Providers to share experiences and also serve as a single point of interaction with the Central Bank and key stakeholders.

Latest figures from GhIPSS show that the use of electronic payment channels that go through GhIPSS platform, went up by 81 per cent in the first quarter of this year compared to the same period last year.

According to Dr Ruth Goodwin-Groen, Managing Director of the United Nations-based Better Than Cash Alliance, “Ghana is already recognised as a global digital payments success story! We look forward to continuing working with our member, the Government, as well as with the private sector and international organisations, to accelerate the new ambitious cash-lite roadmap, in a way that is responsible and responsive to the needs of all Ghanaians.”

BY TIMES REPORTER

News

Man sentenced to 25 years for robbery at Manso Akwasiso

A 30-year-old man has been sentenced to 25 years imprisonment with hard labour by the Bekwai Circuit Court for his role in a 2022 robbery at a mining site at Manso Akwasiso in the Ashanti South Region.

The convict, Dominic Ofori, also known as Fanta, was arrested on 16th February 2026 after years on the run. He pleaded guilty before the Bekwai Circuit Court to robbery contrary to Section 149 of the Criminal Offences Act, 1960 Act 29, and was accordingly sentenced to 25 years imprisonment with hard labour.

On March 20, 2022, the Manso Adubia District Police received intelligence that a group of armed men from Manso Abodom were planning to attack a mining site at Manso Akwasiso to rob the owner of gold concentrate. Acting on the information, police mounted a coordinated operation and laid an ambush at the site.

At about 5:30 pm the same day, four-armed men arrived at the site, fired indiscriminately, and robbed the miners of their gold concentrate. The police team on surveillance intervened, resulting in an exchange of gunfire.

Three of the suspects, Abu Abubakar, Musah Latif, and Gideon Takyi, sustained gunshot wounds and were pronounced dead on arrival at St Martins Catholic Hospital at Agroyesum. Dominic Ofori escaped at the time but was later arrested and put before the court.

The Ashanti South Regional Police Command has assured the public of its continued commitment to combating violent crimes and bringing offenders to justice.

News

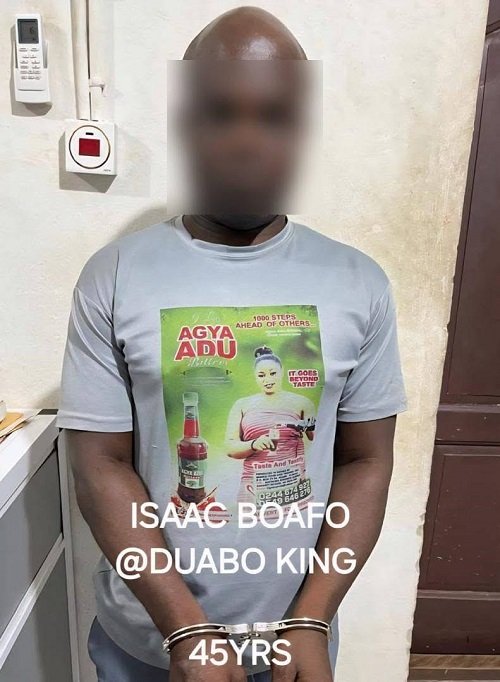

Ashanti police arrest man for publishing false news on TikTok

The Ashanti Regional Police Command has arrested 45-year-old Isaac Boafo, also known as “Duabo King,” for allegedly publishing false news intended to cause fear and panic.

Police said the arrest follows a viral TikTok video in which Boafo claimed that four officers at the Central Police Station in Kumasi engaged in inappropriate conduct with commercial sex workers during night patrols in Asafo.

Officers from the Police Intelligence Directorate (Ashanti Region) apprehended Boafo after receiving intelligence about the video.

During questioning, he admitted to creating the video to attract views and engagement online, and acknowledged that he could not prove the allegations.

Boafo also admitted making comments about the President of the Republic for content purposes and could not defend those statements.

He has been formally charged and is in detention as investigations continue.

The Ashanti Regional Police have warned the public against publishing or sharing false information on social media, noting that such acts can cause fear, panic, and damage reputations.

They said anyone found engaging in similar conduct will face legal action.

By: Jacob Aggrey