News

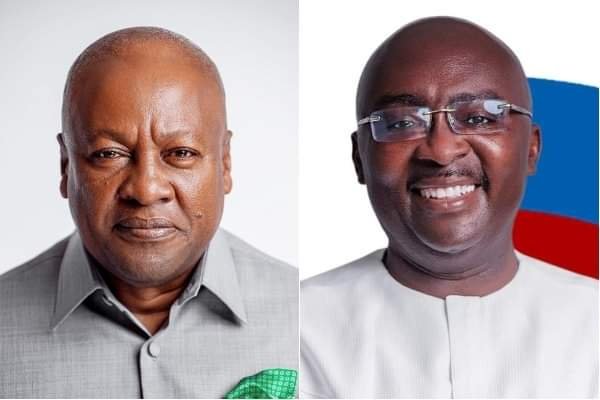

Mahama must understand Banking sector clean-up before commenting – Bawumia

Flagbearer of the New Patriotic Party (NPP) and Vice President of Ghana, Dr.Mahamudu Bawumia has jabbed former President, John Dramani Mahama over the banking sector crisis.

“I’ll ask the former president if he hasn’t read, to go and read the receiver’s report or the BoG’s report and acquaint himself before making any further comments on matters he clearly doesn’t understand,” he said

Addressing Ghanaians during the Media Encounter on Sunday, August 25, he said, the former President needs to get an understanding before making further comments, adding that he cannot hand over a bank’s licence to them, this is subject to legal procedure.He said, “We saved the deposits of 4.6 million bank depositors who really were going to lose their deposits if those banks were not saved. I don’t understand whether the former president has taken his time to understand the banking sector. Some atrocious things and this is why these banks had to be saved.”

Dr.Bawumia further added, “They were not collapsed, they were merged into other banks and no banking depositor lost 1 cedi, everybody maintained. But very bad things happened, some of the banks broke all the rules and extended loans way above the single obligor limits.”

“They were given, in some cases 1 billion by the Bank of Ghana to help them out of the mess and they only got deeper into the situation. Other banks were given capital to save the situation, and they used that money to set up Capital Bank, instead of rescuing the problem that they had. They took the money from the central bank and set up another business which also collapsed. Some took money and invested in private properties,” he added.

Dr.Bawumia concluded that “So, it was against this background the governor came to report, and this was one of my nightmares in the last eight years. Most people didn’t understand how close we were to a collapse of the entire banking system. This is how we had to merge many of these banking sectors into other banks and we saved 4. 6 million depositors.”

By Edem Mensah-Tsotorme